Do you remember what you were doing in 1974?

by The Smart Option, on April 06, 2022

In 1974 the founder of Connors Investor Services, Inc., Jim Connors, began managing its flagship investment strategies of the Connors Covered Call and Connors Small Companies. Other notables in 1974 were: the Dow Jones Industrial Average (DJIA) hit an annual low of 577.60, Blazing Saddles was the top movie and the invention of the Rubik’s Cube.

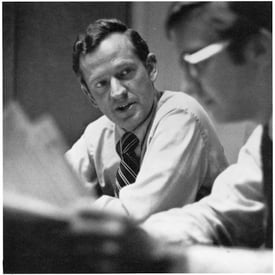

Before starting Connors Investor Services, Jim Connors had a career to be proud of with Carpenter Steel (now Carpenter Technology, a well-regarded specialty steel manufacturer). He had quickly risen through the ranks and was an assistant vice president before starting his company in 1969. Unlike most investment firms, investment management was only a small portion of the Connors business model.

While the company managed a few portfolios, Connors primarily pursued research on small company stocks and sold its expertise to individuals and brokerage firms around the country. Jim circulated six publications a year with about 1,200 subscribers. As its publications became validated and recognized on a national basis, Connors received requests for exclusive research from larger, notable national investment firms.

While the company managed a few portfolios, Connors primarily pursued research on small company stocks and sold its expertise to individuals and brokerage firms around the country. Jim circulated six publications a year with about 1,200 subscribers. As its publications became validated and recognized on a national basis, Connors received requests for exclusive research from larger, notable national investment firms.

Learn more about the Connors Covered Call Strategy and Connors Small Companies Strategy

Important Disclosure:

This material is being provided for informational purposes only. All expressions of opinion reflect the judgment of the author. Opinions are subject to change without notice. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete.