Announcing the Connors Hedged Equity Fund (CVRDX) launched January 19th

by Connors Team, on June 27, 2022

CVRDX encompasses the Connors flagship options-based covered call investment strategy that we have been managing for over fifty years in separate accounts for high-net worth and institutional clients.

We decided to launch the fund for several reasons...

- Many individual investors and institutions could benefit from the lower volatility and increased income associated with the strategy but cannot meet the minimum investment for our separately managed account of $1M.

- The fund will offer the opportunity for smaller accounts to invest in a diversified options-based portfolio. Smaller accounts tend to be challenging to build a diverse portfolio and implement an options-based strategy since it necessitates buying at least 100 shares for each equity position in order to sell 1 call option against the underlying stock.

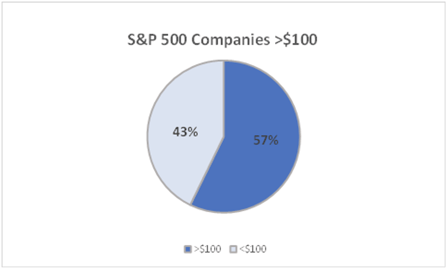

- The chart below depicts the percentage of stocks trading over $100. With more than ½ of the S&P 500 stocks trading over $100

Ex. In order to write 1 call against Palo Alto Networks (PANW) alone would require investing $50,000 to purchase 100 shares.

In addition, the Connors Hedged Equity Fund has the ability to potentially offer additional downside risk mitigation through the use of puts and put spreads.

For more information on the Connors Hedged Equity Fund (CVRDX) click here

Investors should carefully consider the investment objectives, risks, and charges and expenses of the fund before investing. The prospectus contains this and other information about the fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling 833-601-2676 or at www.connorsinvestor.com/mutual-funds. The Connors Hedged Equity Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC. Ultimus Fund Distributors, LLC and Connors Investor Services is separate and unaffiliated.

IMPORTANT RISK INFORMATION:

As with any mutual fund investment, there is a risk that you could lose money by investing in the Fund. The success of the Fund's investment strategy depends largely upon the Adviser's skill in selecting securities for purchase and sale by the Fund and there is no assurance that the Fund will achieve its investment objective. The Fund was formed in 2022 and has no operating history. In addition, although the principals of the Adviser have investment management experience, none have experience managing an open-end mutual fund prior to the Fund.

Investments in options involve risks different from, or possibly greater than, the risks associated with investing directly in the underlying securities. The S&P 500® Index is a capitalization weighted unmanaged index of 500 widely traded stocks, created by Standard & Poor’s. The index is considered to represent the performance of the stock market in general. Indexes do not incur fees and it is not possible to invest directly in an index.