Quarterly Letter - October 2021

by Peter J. Connors, CFA, on October 01, 2021

In a brief year and a half, the pandemic’s economic recovery has transitioned from an energetic youthfulness to an awkward adolescence. Reflecting that youthful spirit, the S&P 500® Index posted above-average returns between 6% and 21% for the past five consecutive quarters and real Gross Domestic Product grew in the second quarter to 6.7% annualized. But now, growing pains of adolescence are evident as we move from recovery to a more normal expansionary phase with growth likely somewhat below recent levels, accompanied by more market volatility. And if adolescense suggests potential, the good news is that we remain in double-digit territory for the calendar year 2021 with the S&P 500®, Dow Jones Industrial Average and Russell 2000® posting gains of 15.9%, 12.1% and 12.4%, respectively. However, several metrics, including consumer spending, housing, the labor market, and business sentiment are signaling slower growth during the quarter. This is not surprising when car dealerships have few cars to sell, consumer products that we have come to depend on remain afloat in cargo ships at sea, and this supply chain disruption has affected everyone in some real way.

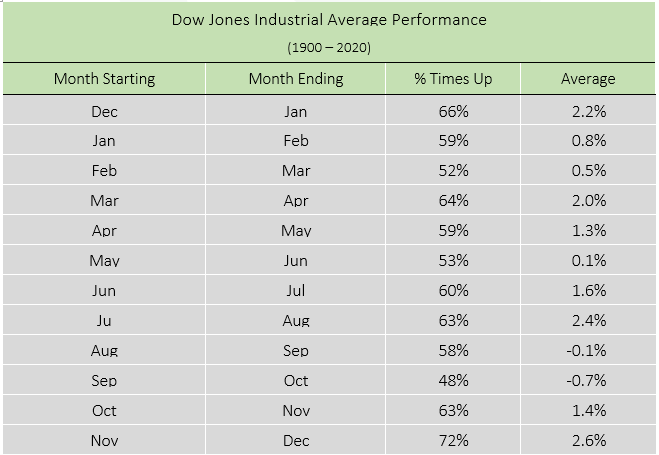

And the major equity indices of the S&P 500® Index, DJIA, and the Russell 2000® Index all downshifted during the quarter returning 0.6%, -1.5% and -4.4%, respectively. In addition, seasonal market performance during September and October has typically been lackluster. The Dow Jones Industrial Average has ended the September/October period higher only 48% of the time, with an average return of negative 0.7% since 1900.

Source: Charles Schwab, SentimenTrader, 1900 – 2020. Table reflects performance achieved by holding the DJIA every year, but only during the indicated starting and ending months. Indexes are unmanaged, do not incur management fees, costs or expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Source: Charles Schwab, SentimenTrader, 1900 – 2020. Table reflects performance achieved by holding the DJIA every year, but only during the indicated starting and ending months. Indexes are unmanaged, do not incur management fees, costs or expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Other uncertainties include COVID-19 headwinds, tax and regulatory risks from legislative plans, and corporate earnings stability. Political risks regarding the debt ceiling are the highest in a decade. Markets may begin to assess the expected impacts of increasing the corporate tax rate and the minimum tax of U.S. companies’ foreign income. Let’s not forget the Federal Reserve and taper talk. It has communicated it will begin tapering bond purchases associated with quantitative easing in the fourth quarter, but markets do not know when the Fed will start to scale back purchases or the pace at which they will be reduced. If the Fed starts to taper sooner than expected, or the pace of reductions is faster than the market has currently priced in, it may cause additional volatility and opportunity in markets.

Like adolescents navigating their journeys, markets can enter into adulthood as consumers remain exceptionally well positioned, in aggregate, with wage and salary earnings above pre-pandemic levels and over $2 trillion in savings accumulated during the pandemic fueling pent-up demand. This could provide strength to the economy and the markets in the months ahead. We continue to focus on quality and stock selection to capture opportunities in those companies with solid balance sheets and good underlying fundamentals.

Stay safe and enjoy your fall.

Sincerely,

Peter J. Connors, CFA

President

Important Disclosure

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Opinions are subject to change without notice.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Connors Investor Services, Inc. [“Connors]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Connors. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Connors account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Connors accounts; and, (3) a description of each comparative benchmark/index is available upon request.