Quarterly Letter - March 2022

by Peter J. Connors, CFA, on May 02, 2022

Post pandemic effects now layered with world tensions are creating continued uncertainty that is rippling through world economies and creating higher than normal volatility. The VIX, the most common measure of market volatility, traded above twenty for 59 of the 62 trading days during the 1st quarter. A reading above twenty is indicative of a high period of market volatility.

Although the S&P 500® Index and the Dow Jones Industrial Average began 2022 at all-time highs, the small-cap index Russell 2000® and tech-heavy Nasdaq dropped over 20% from their November highs. The S&P 500® and Dow Jones followed, declining to a year-to-date intra-day low of -13.5% and -11.2% as Russia invaded Ukraine before settling at -4.6% and -4.1%, respectively for the quarter, delivering the largest quarterly losses in nearly two years.The invasion of Ukraine by Russia was the latest source of uncertainty; however, the factors behind the selloff go beyond this single geopolitical event. A confluence of factors contributed to the challenging start to 2022, including the global economic impact of the war on disrupted pandemic supply chains, soaring energy, food, and metals prices—coupled with rising interest rates, labor shortages, and higher inflation.

Inflation, as measured by the Consumer Price Index, currently sits at 8.5% percent annually and is running at a 40-year high. Seeking to curb inflation, the Federal Reserve began shifting its monetary policy by raising interest rates 0.25% in March for the first time in almost four years and signaling six more increases this year. In addition, the Fed indicated it will begin reducing its $9 trillion balance sheet that swelled since March 2020 when the Fed provided monetary purchasing of over $4 trillion of assets during the COVID-19 pandemic. Quantitative tightening, a reduction of the Feds balance sheet, will create more pressure on credit markets which may add further upward pressure on interest rates.

While every tightening cycle is different, it is worthwhile to use history as a guidepost for what may lie ahead. Normally, higher interest rates will result in higher borrowing costs for both consumers and businesses. This means households will have less discretionary income to spend and companies are unwilling to borrow to expand. Tech and growth stocks have typically underperformed, as the rise in bond yields pressure the value of future cash flows of those stocks’ valuations. There have been major moves in the bond market this year. Yields on the two-year U.S. Treasury bonds are up more than threefold to 2.3%, with the longer-term 10-year Treasury rising almost 100 basis points, briefly touching 2.5%, and above 2.9% as of the writing of this letter.

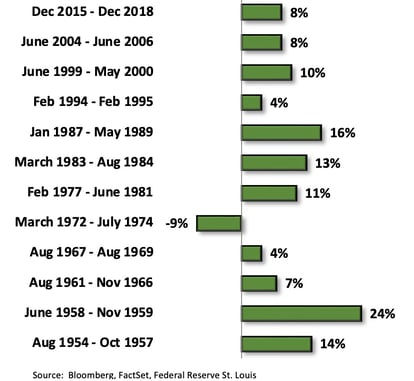

However, the market performance during previous Fed tightening cycles will surprise most readers. There have been 12 rate hike cycles since 1954. During previous cycles, large-cap stocks measured by the S&P 500® posted total returns on average of 9.5% annualized and all but one, March 1972, saw positive returns. Small-cap stocks, using data from Ibbotson and the Russell 2000®, returned an average annual 10.6% during the same 12 periods.

However, the market performance during previous Fed tightening cycles will surprise most readers. There have been 12 rate hike cycles since 1954. During previous cycles, large-cap stocks measured by the S&P 500® posted total returns on average of 9.5% annualized and all but one, March 1972, saw positive returns. Small-cap stocks, using data from Ibbotson and the Russell 2000®, returned an average annual 10.6% during the same 12 periods.

Shifts in monetary policy are accompanied by greater uncertainty and volatility, however history has shown that markets generally deliver positive returns as rates rise, albeit against wealth changes due to inflation driven spending power erosion. While every cycle is different, the data shows that the Fed's initiation of a monetary tightening campaign isn’t, by default, a harbinger of bad news.

As companies navigate higher inflation and interest rates with varying agility, we continue to actively manage client portfolios seeking companies with strong profitability, low debt levels and experienced management. Times of uncertainty can test investors’ fortitude. These are moments when active, fundamental-based stock selection, thoughtful portfolio construction and avoiding overreaction, can have a critical impact on the success of one’s long-term financial goals.

Sincerely,

Peter J. Connors, CFA

President

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Connors Investor Services, Inc. [“Connors]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Connors. Please remember, if you are a Connors client, to contact Connors, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Also, remember to advise us if you have to been receiving account statements (at least quarterly) from the account custodian. Connors is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Connors’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.connorsinvestor.com. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Connors account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Connors accounts; and, (3) a description of each comparative benchmark/index is available upon request.