Quarterly Letter - July 2020

by Peter J. Connors, CFA, on July 01, 2020

Well, that was quite a quarter! A collective sigh of relief could be heard by investors who either sat tight with their existing investments or those who put cash to work, as the overall market moved up approximately 40% from its March 2020 lows. We witnessed the fastest 30% drawdown in the history of global equities in the first quarter, followed by the largest 50-day advance in market history in the second. The S&P 500® climbed back above 3,100 by early June and the Nasdaq hit a record high a week later.

The U.S. economy experienced a historic slowdown through April with, at one point, 95 percent of Americans under stay-at-home orders, wearing masks and social distancing. As you can imagine, some industries boomed, and others slowed to a crawl. The fiscal and monetary response was extreme and unique. The Federal Reserve cut interest rates to zero, committed to buying investment-grade and high-yield corporate bonds and announced unlimited quantitative easing as long as needed. The fiscal stimulus packages include forgivable loans to small businesses (PPP program) and unemployment benefits equal to wage income for many. More checks may be on the way, along with a possible payroll tax relief program. One thing we know is that unprecedented circumstances have given rise to unparalleled responses, and it is not over yet.

The number of U.S. virus cases is still growing, with many states pausing their reopening plans. The reaction to a decisive “second wave” is an obvious downside risk. Tensions with China and domestic social unrest may also keep markets from rising past present levels. As we all know, however, there are also factors that may help markets steady and eventually find new highs, such as a COVID-19 vaccine or additional stimulus. Also, because it was announced that we will have low interest rates for the foreseeable future, stocks may once again be the choice of investors looking for attractive yields and growth potential. Pundits have many views on current fiscal and monetary support, and more may be on the horizon depending on the path of the recovery. We are relieved to see the S&P 500® up 40% from its recent market low, but a lot of uncertainly lies ahead including a presidential election in November. The VIX® Index, which measures market volatility, remained elevated in the second quarter at nearly 35, though off the high of over 80 in the first quarter. We expect volatility to remain elevated for some time.

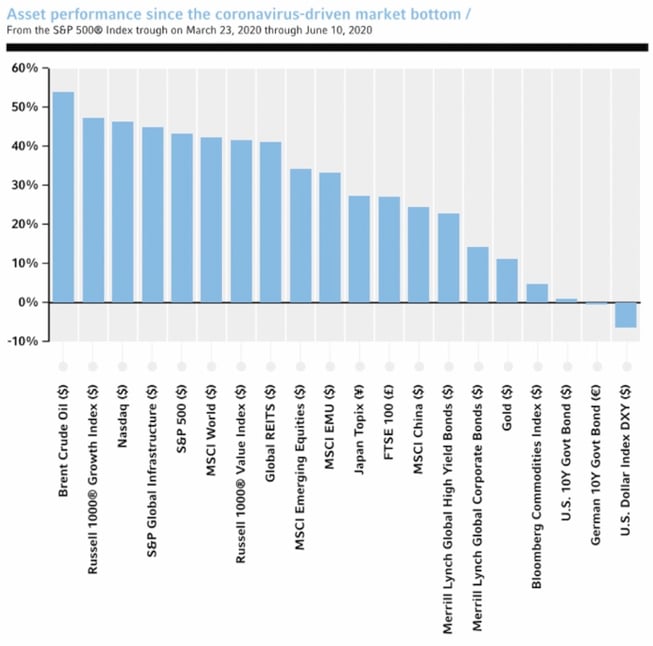

The chart on the next page shows that most market indices experienced healthy bounces off their lows in late March through June 10, although not equally. The S&P 500® returned +20.5% for the

quarter with sectors such as Technology and Energy leading the way, while areas that held up during the decline trailed during the comeback, such as Treasury bonds, gold and commodities.

During strong market downturns, it is natural to be concerned, but we have learned that staying the course and allowing circumstances to pass may be the best path to pursue for long-term investors. We took advantage of the opportunities this market downturn provided to enhance portfolios in this challenging environment.

Our team continues to carefully monitor market conditions as we manage your portfolio to meet your objectives.

We are here for you. Please don’t hesitate to reach out to us anytime.

Stay safe, everyone.

Sincerely,

Important Disclosure

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Opinions are subject to change without notice.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Connors Investor Services, Inc. [“Connors]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Connors. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Connors account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Connors accounts; and, (3) a description of each comparative benchmark/index is available upon request.