Market Update

by Debora Covell, CRPC®, on May 12, 2022

With the recent market volatility, we thought an interim communication may be helpful.

|

Market Volatility -- the market |

2022 has been a year of adjustment with market volatility a predominant theme. The VIX, the most common measure of market volatility, has traded above twenty for 87 of the 90 trading days. A reading above twenty is indicative of a high period of market volatility. |

|

Pullbacks -- market pullbacks can be

|

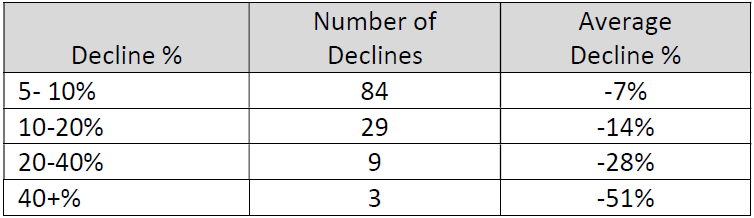

While no one looks forward to market swings, it is not surprising that 2022 is experiencing volatility and a reset after the S&P 500® Index posted three consecutive years of double-digit returns from 2019 to 2021, a streak not experienced since 1999. In addition, with the Fed shifting its monetary policy by raising interest rates and reducing its $9 trillion balance sheet, the markets are reacting. A historical perspective on the frequency and severity of past drops can provide a valuable perspective, although past performance is not a guarantee for future returns. Market pullbacks are more common than some may think. Below is a chart of market pullbacks in the S&P 500® post- World War II: |

|

Timing the market can be difficult.

|

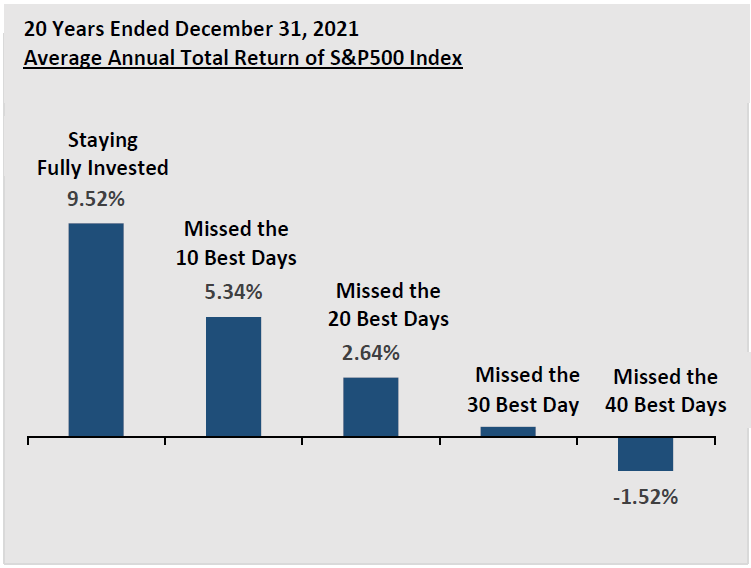

When markets become volatile, it may be tempting to sell out of stocks to avoid downturns, but it is challenging to time it right. Investors may try to guess when stocks will bottom out. Jumping in and out of the markets, buying stocks at market bottoms, and selling only when prices are high is difficult, if not impossible.

|

Important Disclosure:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Connors Investor Services, Inc. [“Connors”]), or any non-investment related content made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Connors. Please remember to contact Connors, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Connors is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Connors’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request.